Long-term financial targets

The Board of Directors decided on October 26, 2021 on the following updated long-term financial targets:

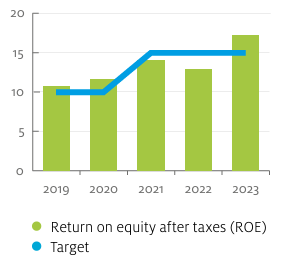

- Return on equity after taxes (ROE) shall exceed 15 per cent over time.

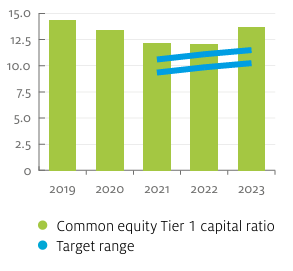

- The common equity Tier 1 capital ratio shall exceed the FIN-FSA’s minimum requirement by 1.75-3.0 percentage points.

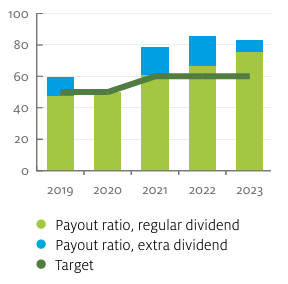

- The payout ratio shall be 60 per cent of shareholders' interest in profit or higher, provided that capital adequacy does not fall below target.

The previous targets, which the Bank of Åland had since 2013 with only minor adjustments in their language, were:

- Return on equity after taxes (ROE) shall exceed 10 per cent.

- The Bank’s capital adequacy, primarily defined as the common equity Tier 1 capital ratio under the Basel regulations, shall clearly exceed all regulatory requirements.

- The payout ratio shall eventually amount to 50 per cent. The payout ratio target presupposes that the capital adequacy target can be maintained.

The Bank of Åland has a strategy and business model which imply that a growing proportion of earnings will come from asset management operations, IT operations and business partnerships that require comparatively limited equity capital. Combined with the growth that the Bank has experienced, this justifies raising the profitability target – expressed as return on equity after taxes – from 10 to 15 per cent.

The newly quantified target of a common equity Tier 1 capital ratio that is at least 1.75 percentage points above the minimum required by regulatory authorities indicates a slightly higher minimum than is customary in the banking sector. This reflects the Bank of Åland’s conservative approach to risk.

As long as the capital adequacy target is achieved, at least 60 per cent of profit for the year shall be distributed to shareholders. In order to ensure efficient use of capital, share repurchases may also be employed.

Long-term financial targets - result

Return on equity after taxes, per cent

Common equity tier 1 capital ratio, per cent

Payout ratio, per cent